Checklist for a business loan application

In the following article, we summarize what documents are required for a business loan application and examine what the role of certain pieces of information is when it comes to the final decision.

Applying for a loan is a rather complex process. It includes numerous steps and it is easy to get lost in the flood of documents and the many different phases. In all cases, companies are required to present documents which support their creditworthiness, hence it is a must to know in advance what kind of documents we need to submit in order to get the business loan we need.

Overall, the point of submitting credit documentation is to verify from credible sources that the applicant company is entitled to apply for the loan, the collateral meets the legal requirements and the applicant will be able to repay the total loan amount. No two business loans are identical, in most cases we are facing unique situations.

This is why at Hitelpont, we strive to provide our clients with the necessary assistance in gathering all the documents, thus making the loan application process more effective and simpler. At the beginning of the process, we compile a list of documents for our clients so that they can make sure that all the information is at hand when needed.

LOAN PRODUCTS AVAILABLE AT HITELPONT:

MFB Business Financing Investment Loan

MFB Business Financing Working Capital Loan

How is the loan application documentation structured?

When submitting a loan application, for each financier one must submit their own, product-specific loan application documentation. The basic details related to the requested loan product should be provided on a loan application form, which can be supplemented by various statements – this is especially important for subsidized loan products. In addition to the application form and the statements, businesses also need to provide their financial and business plan, where they need to present detailed information about the company’s current activity and operations, as well as the loan objective.

It is also essential that the applicant proves the company’s existence, corporate network and background, as well as its management and financial information, tax-related certificates serve as proof that the business has no debts. The following phase is the documentation related to the collateral.

The documents proving the intended use of the loan vary depending on the loan objective.

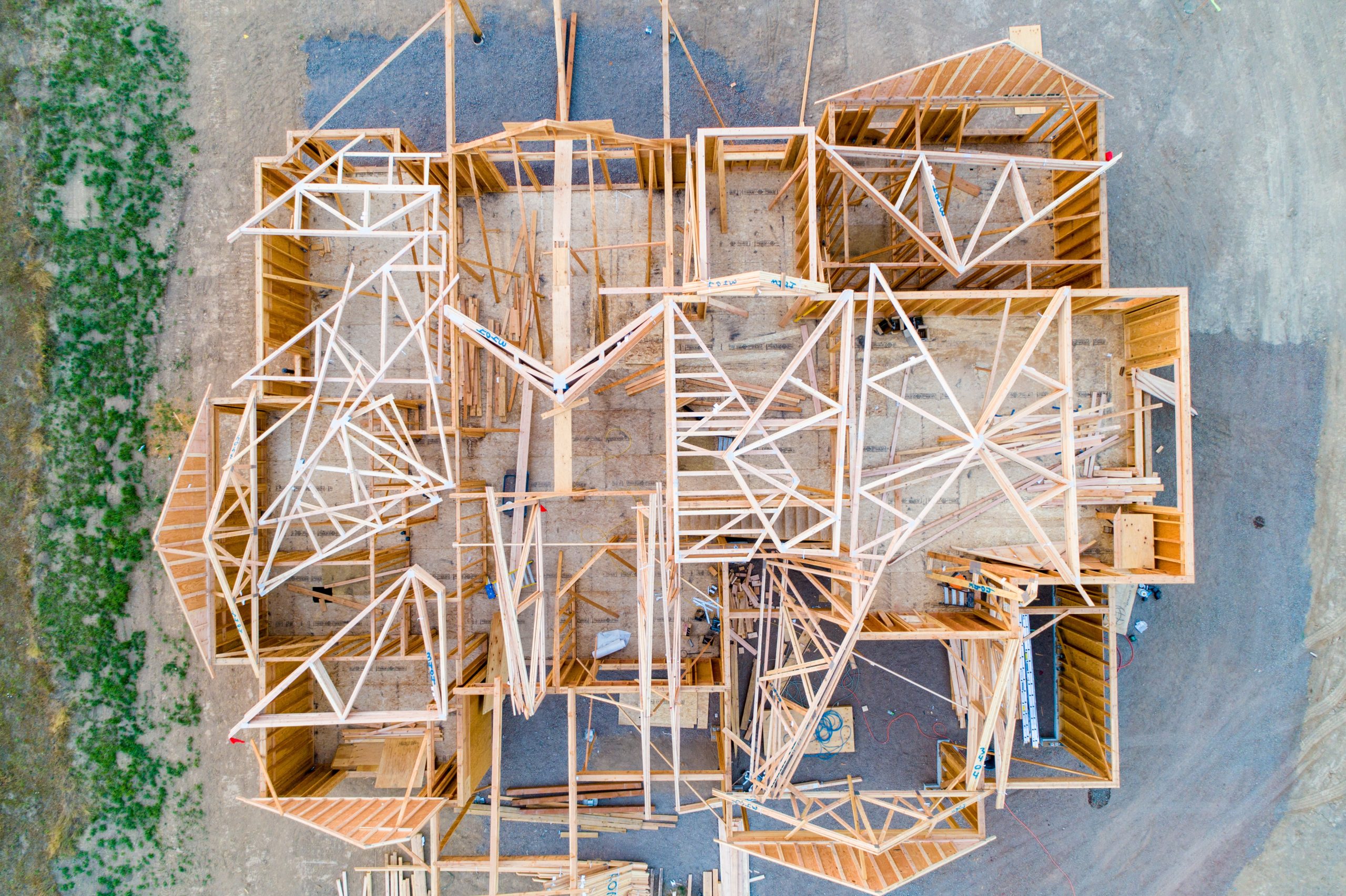

At Hitelpont, we strive to give all the help our clients need to submit the necessary documentation promptly and correctly. (Source: Gabrielle Henderson, Unsplash)

Classifications: sole proprietorships or joint ventures

The necessary documentation can differ when it comes to sole proprietorships and joint ventures. The main reason for this is that sole proprietorships are registered through the local council, whereas joint ventures can only be established through company court registration. The different foundation process and place of registration results in different documentation requirements for proving the company’s legal operation.

Company law documents

Company law documents prove the existence of the business and assure that it meets the requirements of a lawful operation. Sole proprietorships need to present the original certificate of operation, this document is issued by the municipality. In addition to that, the administrative authorisation and operational licence must be submitted, if the business is subject to a license or registration. If chamber membership is also required for the business activity, the chamber registration document is also needed.

In the case of joint ventures, the required documents differ greatly. The operation of the business can be proved by a company statement issued in the last 30 days, certified by a notary or a lawyer. Apart from this, the signature title and the current articles of association are also necessary. The legal form of the company can be found in the latter, and the certificate of incorporation is also obtained from this document. In the Opten company information system, we can verify the last modification date of the document, we always make sure that the newest version is included in the documentation. It is also important to note that if there is a guarantor or the collateral is provided by another company, it is indispensable that they also provide the related documents.

Financial and management documents

The company’s management can be graded by evaluating multiple documents. The most significant documents are the ones officially representing the company’s finances.

For sole proprietors, it is required to submit their SZJA (personal income tax) or EVA (simplified income tax) declarations for the past 2 years (in 2020 they require the declarations for 2019 and 2018), these documents also confirm the economic results of the previous years. It is also possible to apply for a loan, even if the business was established less than 2 years ago and is unable to present financial statements for the years 2018 and 2019. The submission of the revenue record is also mandatory for the 2020 and 2019 business years, as well as a bank statement for the past 3 months so that the company’s cash flow can also be examined, inspecting where their revenues come from and how steady their income is. As sole proprietorships do not necessarily need to have a separate, entrepreneurial bank account, in this case, their own personal account will be examined.

For joint ventures, it is necessary to present the financial report of 2019 (this document is typically expected of loan applicants, whether the deadline has passed or not) this includes the profit and loss statement and the balance sheet as well. They also need to present the bank account agreement, a bank statement for the last 3 months and an extract from the General Ledger, supporting the annual report of the year 2019. The General Ledger of 2020 is required so that we can get a deeper understanding of the current year’s management. For larger loan amounts or more complex loan purposes, we may also need customer-, supplier- and tangible asset analysis.

At Hitelpont, startups or companies in early stages can also apply for loans, but in all cases, real estate collateral is expected. (Source: You X Ventures, Unsplash)

Tax-related documents

The purpose of tax documents is to prove that the business has no tax or social security debts. It is a requirement for both sole proprietorships and joint ventures to have a NAV (Hungarian National Tax Office) certificate of solvency, in which the tax authority verifies that the business has no public dues. The regularity of tax payments is also visible on the NAV current account statement, late payments can be a risk factor for example. NAV documents can also be retrieved online, through the Ügyfélkapu (official Hungarian state portal).

The Municipal Tax Certificate provides information about the settlement of taxes paid to the Municipality, it also shows that there are no outstanding dues (for example business tax, vehicle tax or construction tax). This document can also be retrieved online, however, if the company has several premises or its registered office is in the capital, this document must be requested from all municipalities involved. (in case of Budapest, documents are needed both from the capital’s and the district’s municipality)

Documents of individuals

The documents mentioned here primarily serve the purpose of client identification. As there can be several participants of one transaction (participants can either be companies or individuals, a business can have several owners and managers), in this case all participants are required to present a copy of their identification documents, thus fulfilling all the legal requirements. In addition to this, owners, managers, guarantors and other authorized signatories need to present their identity card, address card and tax card.

Documents related to real estate collateral

At Hitelpont, we only provide loans with real estate collateral, in regard to this it is necessary to present the property. During the pre-qualification process, we request a land registry deed issued within the past 30 days, a copy of the land registry map (if the property is not a condominium) and the floor plan of the property is also required. After the pre-qualification, a land appraisal is carried out by the partners of Hitelpont. In the case of undivided joint ownership, a usage agreement is also required, it is important to examine whether the ownership agreement allows the property to be encumbered with a mortgage. We also need to know whether the property is limited by any lawsuit, encumbrance or claim record.

Loan application form and other statements

This part of the documentation is filled in by the client, the current operation of the company and the purpose of the loan must be presented in detail. The form also includes the business plan and other statements related to the loan application, such as statements related to the Central Credit Information System (KHR), Money Laundering Act, and the Transparency statement.

The documentation needs differ based on the loan objective. It is important that the client is able to prove what the requested amount was spent on. (Source: Avel Chuklanov, Unsplash)

Documents related to the loan objective

As all the loan products available at Hitelpont are subsidized loans, they are all tied to credit purposes – if it is not an untied loan, the loan objective must be justified. Depending on the type of loan, the need for documentation also differs. The following documents are required depending on the loan objective:

- Purchase of real estate: the original declaration of intent or pre-contract, later the official property purchase agreement;

- Construction or renovation: detailed budget plan, building permit;

- Purchase of assets: quotations.

In case of a construction project, the budget plan prepared by the contractor must list the material and labour costs separately, thus making it clear what the loan amount was spent on. A building permit is only required if the construction is subject to licensing.

We hope that reading our article made the loan documentation process and the requirements a little clearer. It might seem complicated at first glance, but at Hitelpont we strive to provide our clients with all the necessary support during the loan application process.

In case you are interested in any of our loan schemes, you can obtain more information by clicking on the Our Products button. On the bottom of all the loan product pages, you can find the loan calculator, which can be used to calculate the expected repayment installments. The loan application process can be initiated online, it is also possible to request a callback from one of our colleagues. Should you have any other questions or be interested in a loan product available at Hitelpont, please call our customer service directly at +36-(70)-654-2486 or reach out to us at one of our Contact details.

RELATED ARTICLES:

2020.05.18. – Comparison of Crisis Loans in Hungary – Which product is worth applying for?

2020.05.16. – Why financial enterprises can be good alternatives when our loan application gets rejected by commercial banks?