The MFB Crisis Loan is available at Hitelpont from the 30th April

The Hungarian government is supporting the financial stability of domestic micro, small and medium-sized companies through the Hungarian Development Bank (Magyar Fejlesztési Bank, MFB) and the group of companies belonging to them (MFB Csoport). This is done through a financial package totalling 1490 billion HUF – with multiple loan constructions they are ready to ease the financial consequences of the crisis.

In order to offset the economic issues that surfaced during the crisis, it ensures the operation of domestic businesses with a refinanced loan product that offers very similar conditions to those of the NHP Hajrá programme. The purpose of the MFB Crisis Loan is support micro- and small-sized companies and to provide funds for domestic SMEs with a total amount of 180 billion HUF.

LOAN PRODUCTS CURRENTLY AVAILABLE AT HITELPONT:

MFB Business Financing Investment Loan

MFB Business Financing Working Capital Loan

THE MFB CRISIS LOAN IS AVAILABLE AT HITELPONT FROM THE 30th APRIL, THE LOAN APPLICATION PROCESS CAN BE INITIATED ONLINE, CONTACT US AT ONE OF OUR CONTACT DETAILS, OR CALL US AT +36-(70)-654-2486.

You can find all relevant information on the product page, however, we found it useful to present the product a bit more in detail, so it is worth browsing through the article below.

The MFB Crisis Loan is part of the government’s financial rescue package, that targets the smaller participants of the Hungarian economy. (Source: Matthew Waring, Unsplash)

Through the NHP Hajrá and MFB Competitiveness Loan programmes, companies have the opportunity of carrying out major projects, realizing larger investments and obtaining the necessary financing for them.

The MFB Crisis loan helps those companies who are still relatively small, start-ups (or do not have one full closed business year behind their back), or those that cannot be financed through commercial banks for any reason.

The loan can help micro and small-sized companies retain their employees, provides a solution to liquidity problems, encourages developments within the business and can also help businesses stay in Hungarian hands during the crisis. One of the main goals was that Hungarian companies not only survive the crisis but to actively participate in the growth of the economy while overcoming financial difficulties.

No time to rest after the crisis. Domestic SMEs can be stable players in the Hungarian economic growth with the help of the MFB Crisis Loan. (Source: Annie Spratt, Unsplash)

The purpose of the MFB Crisis Loan Programme

Through the MFB Crisis Loan (which is implemented under the framework of the MNB NHP Hajrá loan programme) a loan amount of 180 billion HUF is available for loan applicants. The main aim is to provide businesses with resources in the short, medium, and long term to reduce losses resulting from the COVID-19 crisis. Due to the favourable pricing of the Crisis Loan, it can be an effective tool for crisis management, domestic companies will be able to meet their arising financial needs, thus MFB can reduce the extent of the economic downturn following the crisis (with the help of the financial companies who carry out the programme).

Unlike the NHP Hajrá Loan, the MFB Crisis Loan provides a solution to those companies, whose financing needs cannot be met by commercial banks for any reason. This way the loan is also ideal for higher-risk companies or those applying for a lower loan amount, with very favourable terms. With a high available loan amount and a wide range of loan objectives help domestic businesses, this is complemented by interest rate subsidies and a state guarantee, thus creating a business loan that benefits many.

The most important conditions

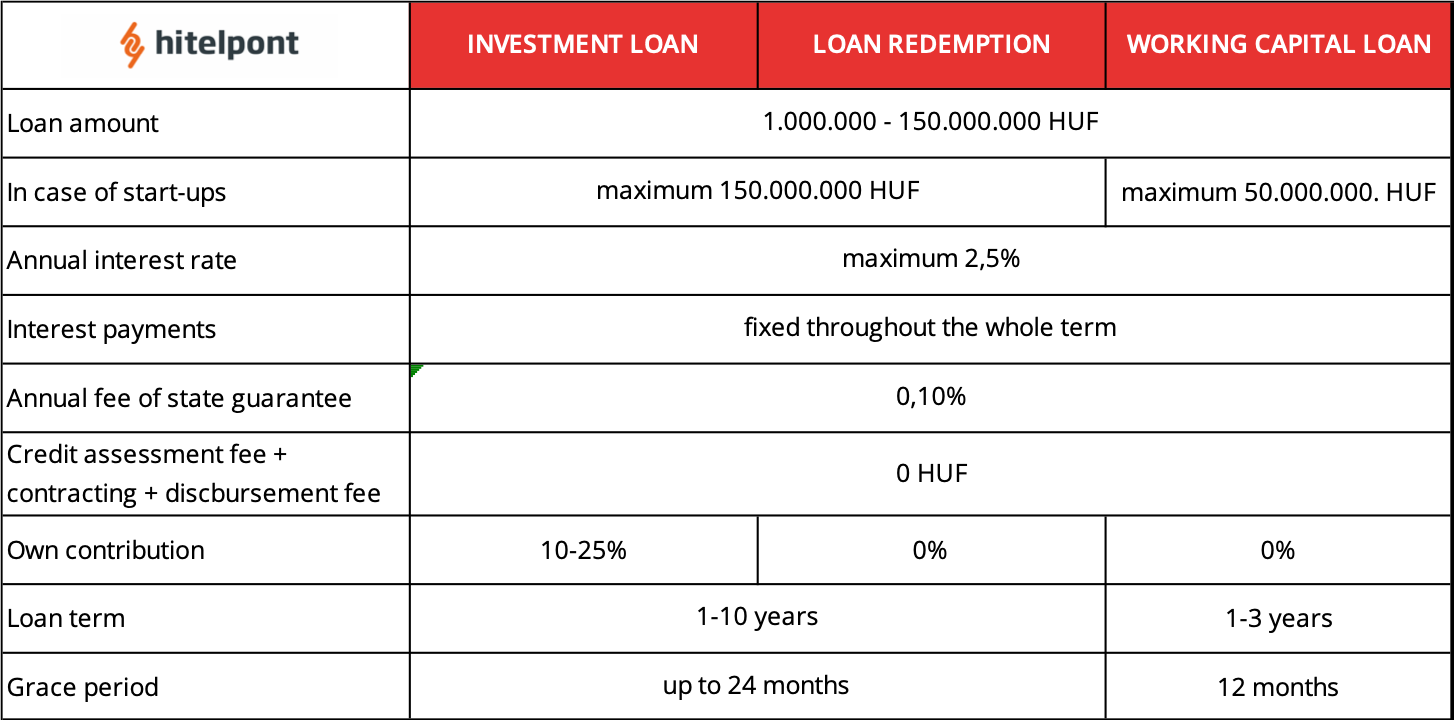

The MFB Crisis Loan appears on the market with three possible use cases: Investment loan, Loan redemption loan and Working capital loan. In all 3 cases, the maximal loan amount can be up to 150 million HUF, the lower limit is 1 million HUF. When it comes to the loan objectives, in the case of an Investment Crisis Loan, the requirements set in the NHP Hajrá programme must be complied with. The 2.5% fixed annual interest rate includes an interest subsidy, the principal repayment and interest payments are due on a quarterly basis.

For the details of the loan products, you can read the product guide on the MFB website or enquire about the product from one of our colleagues at our Contact details.

An important additional support for the MFB Crisis loan is an 80% state payment guarantee, which enables financial companies to take on higher risks in the unfavourable economic environment. The fee of the state guarantee is 0,1% per year, calculated based on the 80% of the outstanding principal amount. Thus, the rate of annual interest fees cannot exceed 2,6%. In the case of the Investment Loan and Loan redemption, the loan term can range from 1 to 10 years, as in the case of a Working capital loan it ranges from 1 to 3 years.

Even start-ups or smaller businesses can apply for the MFB Crisis Loan, submitting a financial report for the previous year is not required. (Source: Green Chameleon, Unsplash)

Loan purpose and objectives

Investment loan

The Investment Loan can be used for general investment purposes.

This includes:

- purchase of new or tangible assets

- modernization of own tangible assets

- capacity expansion

- purchase of real estate

- investment

- purchase of machinery

- purchase of other intangible assets

- site development

In fact, all loan objectives are accepted that meet the conditions of the NHP Hajrá programme.

Working capital loan

In the case of a Working capital loan, it is possible to purchase current assets as well as getting financing to help the businesses’ liquidity.

In addition to the usual inventory and customer financing loan purposes, the loan amount can also be used to cover operating costs as well as personnel expenses.

In terms of the loan composition, at least 50% of the amount should be used to finance current assets (this includes the financing of trade receivables overdue for up to 30 days). Costs related to the operation of the business cannot exceed 50%.

This includes:

- personnel expenses

- utility costs

- rent

- service charges

- marketing costs

- maintenance, reparation costs

The working capital loan is of a non-revolving type, cannot be renewed, extended or replaced by another working capital loan.

Loan redemption

In the case of a loan redemption, investment loans provided by domestic financial institutions until the 1st January 2020 may be refinanced.

Range of loan applicants, restrictions

It is important to note that in the case of an Investment Loan, a minimum of 10% self-sufficiency is required, this is also a rather favourable parameter of the MFB Crisis Loan. In the case of the Working capital loan and Loan redemption, no own funds are required.

The loans are available for SMEs, including sole proprietors, start-ups and smaller companies.

A SIGNIFICANT DIFFERENCE BETWEEN THE NHP HAJRÁ AND THE MFB CRISIS LOAN IS THAT THE CRISIS LOAN CAN ALSO BE APPLIED FOR BY SMALLER COMPANIES OR EVEN START-UPS, PRESENTING THE FINANCIAL REPORT OF THE LAST BUSINESS YEAR IS NOT A REQUIREMENT.

In the case of a working capital loan, if the requested loan amount is above 50 million HUF, the amount should not exceed the 1/3rd of the sales revenue of the last closed business year – to decipher this, the business must have the financial report for the year 2019. This means that start-ups can only apply for a working capital loan if the amount is under 50 million HUF. Above 50 million HUF, it is also essential that the operating results of the past 2 years are not negative in any case.

Other reasons for exclusion

- No court registration (except for sole proprietors)

- Cancelled tax number

- Outgoing bankruptcy, or liquidation process

- Overdue tax or bank debt

- State or municipal shareholding (more than 25%)

The fixed annual 2,5% interest rate and the wide range of loan objectives are a big help for domestic businesses in times of the crisis. (Source: Charles Deluvio, Unsplash)

Sureties, collaterals

Due to the state guarantee, the conditions of the collateral are more lenient than the usual, however, applying for a loan is only possible when providing real estate collateral.

For all types of loans, the collateral should cover at least half of the loan principal and half of the interest that is due in the first year, this is supplemented by the state guarantee.

In the case of an investment loan and a loan redemption loan, the subject of the investment is automatically collateral for the loan, a mortgage is registered for the real estate, as well as a prohibition of alienation and encumbrance.

In case of a working capital loan, a real estate mortgage and/or a movable lien and/or a claim-based lien may be used.

Mortgages on other real estates can also be used as additional collateral, for all loan types.

In addition to the mandatory collaterals, the following supplementary sureties may be used:

- full guarantees from individuals or related undertakings

- security based on a payment account claim

- cash deposit

- lien based on a claim

In case you are interested in any of our loan schemes, you can obtain more information by clicking on the Our Products button. On the bottom of all the loan product pages, you can find the loan calculator, which can be used to calculate the expected repayment instalments. The loan application process can be initiated online, it is also possible to request a callback from one of our colleagues. Should you have any other questions or be interested in a loan product available at Hitelpont, please call our customer service directly at +36-(70)-654-2486 or reach out to us at one of our Contact details.